High-Frequency Trading (HFT) involves automated, algorithm-driven strategies executing trades at ultra-fast speeds, leveraging advanced technologies to capitalize on micro-market opportunities, making it a cornerstone of modern financial markets.

Definition and Overview of HFT

High-Frequency Trading (HFT) is a type of algorithmic trading that uses automated systems to execute trades at extremely high speeds, often in milliseconds or microseconds. These systems analyze vast amounts of market data to identify profitable opportunities, enabling rapid decision-making and execution. HFT strategies are designed to capture small price inefficiencies across various financial instruments, making it a key component of modern financial markets.

Importance of HFT in Modern Financial Markets

High-Frequency Trading (HFT) plays a pivotal role in modern financial markets by enhancing liquidity, reducing bid-ask spreads, and promoting market efficiency. Its ability to execute trades at lightning speed ensures tighter price discovery, benefiting all market participants. HFT also fosters competition among trading firms, driving innovation in technology and strategies. Additionally, it enables institutional investors to manage large orders with minimal market impact, making it a cornerstone of contemporary trading ecosystems.

Key Components of HFT Systems

High-Frequency Trading systems rely on low-latency hardware, sophisticated software algorithms, and real-time data feeds to execute trades at unprecedented speeds, ensuring optimal performance and precision.

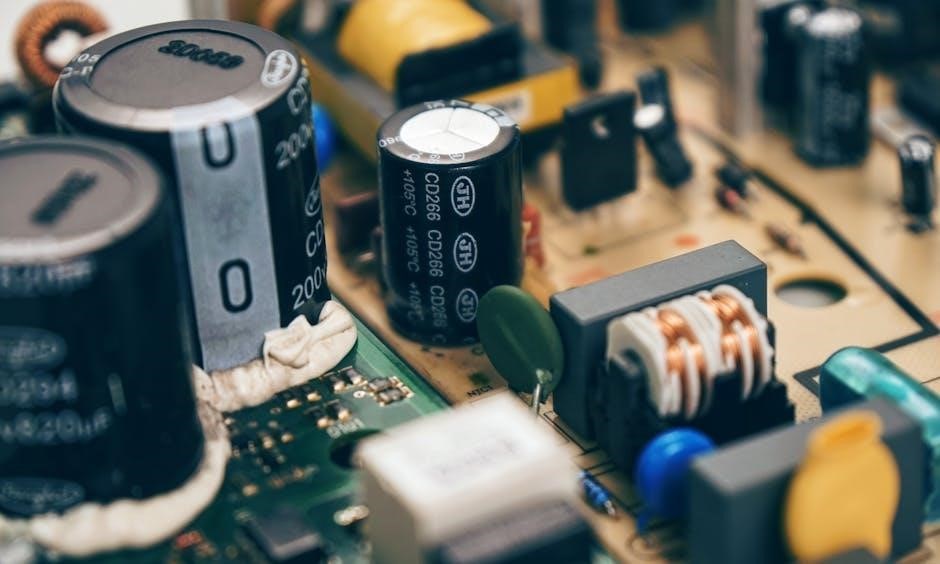

Hardware Infrastructure for Low-Latency Trading

High-Frequency Trading systems require specialized hardware to minimize latency. Key components include high-performance servers, optimized network interfaces (NICs), and low-latency switches. Field-Programmable Gate Arrays (FPGAs) are increasingly used for deterministic execution. Additionally, proximity hosting in data centers reduces communication delays, ensuring faster data transmission and order execution. These hardware optimizations enable HFT systems to operate at microsecond or even nanosecond speeds, crucial for maintaining a competitive edge in fast-paced markets.

Software Tools for Algorithm Development

Developing high-frequency trading algorithms relies on advanced software tools. Programming languages like Python, C++, and Java are commonly used for their flexibility and performance. Specialized frameworks such as Apache Spark and MATLAB enable rapid prototyping and data analysis. Additionally, libraries like NumPy and pandas facilitate efficient data processing, while tools like MetaTrader and QuantConnect provide platforms for strategy development and backtesting, ensuring robust and scalable algorithmic solutions for HFT systems.

Data Sources and Market Connectivity

High-frequency trading relies on real-time market data feeds and robust connectivity to exchanges. Data sources include direct exchange feeds, consolidated data providers, and third-party vendors. APIs and low-latency networks enable rapid access to market information, ensuring precise order execution. Connectivity tools like FIX protocol and direct market access (DMA) are essential for integrating with trading venues. Accurate and timely data is critical for algorithmic decision-making, making data sources and connectivity foundational to HFT system performance.

Development Process of HFT Systems

The development process involves strategy design, backtesting, implementation, and rigorous testing. It ensures systems are optimized for performance and validated for reliable execution in live markets.

Strategy Design and Backtesting

Strategy design involves creating algorithms to exploit market inefficiencies, while backtesting evaluates performance using historical data. This process ensures robustness, profitability, and risk management. Engineers refine strategies based on backtest results, ensuring they adapt to evolving market conditions. Effective backtesting validates the strategy’s viability and reliability, minimizing potential risks in live trading environments. This iterative process is critical for developing consistently profitable high-frequency trading systems.

Implementation and Optimization

Implementation involves translating the designed strategy into executable code using languages like Java, C++, or Python. Optimization focuses on refining the system for speed and efficiency, minimizing latency, and maximizing throughput. Engineers leverage high-performance computing frameworks and hardware accelerators like FPGAs to enhance execution speed. Continuous testing ensures scalability and reliability. Regular updates and fine-tuning are essential to maintain competitive performance and adapt to market changes, ensuring the system operates at peak efficiency and adheres to regulatory standards.

Testing and Validation

Testing and validation are critical to ensure HFT systems perform reliably under real-market conditions. Backtesting evaluates historical data, while forward testing assesses live-market simulations. Rigorous validation checks for algorithmic accuracy, latency optimization, and fault tolerance. Performance metrics like execution speed and profitability are analyzed. Continuous monitoring ensures compliance with regulatory requirements, minimizing operational risks and ensuring robustness. These steps ensure the system is reliable, efficient, and ready for deployment in competitive trading environments, avoiding costly errors and ensuring long-term profitability.

Popular HFT Strategies

Popular HFT strategies include market-making, trend-following, statistical arbitrage, and event-driven approaches. These strategies leverage speed and data analysis to capture fleeting market opportunities efficiently and profitably.

Market-Making and Liquidity Provision

Market-making involves continuously providing bid and ask quotes to facilitate trading, ensuring market efficiency. HFT firms act as market makers, using algorithms to adjust prices and manage inventory. By analyzing order book dynamics and market trends, they capture spreads while minimizing risks. This strategy requires ultra-low latency and precise execution to profit from fleeting price discrepancies. Effective market-making enhances liquidity, reduces volatility, and maintains orderly markets, making it a cornerstone of HFT operations.

Trend-Following and Statistical Arbitrage

Trend-following strategies identify and capitalize on directional market movements using indicators like moving averages or momentum metrics. Statistical arbitrage exploits price inefficiencies between correlated assets through mean-reversion techniques. Both approaches leverage advanced algorithms to analyze vast datasets, enabling HFT systems to execute trades swiftly. These strategies require robust data processing and precise timing to capture small, fleeting opportunities, making them highly dependent on low-latency infrastructure and sophisticated risk management systems.

Event-Driven and News-Based Strategies

Event-driven strategies capitalize on market reactions to news, such as earnings reports or geopolitical events. These systems use natural language processing to analyze real-time news feeds and execute trades before prices adjust. By leveraging rapid data processing, HFT systems can identify and act on information milliseconds ahead of competitors. This approach relies heavily on accurate news interpretation and ultra-fast execution to capture short-term price movements effectively.

Challenges in HFT Development

Developing HFT systems requires overcoming latency reduction, ensuring regulatory compliance, and adapting to dynamic markets. These challenges demand advanced infrastructure, precise algorithms, and continuous system optimization.

Latency Reduction and Performance Optimization

Latency reduction is critical in HFT, requiring optimized hardware, such as FPGAs, and low-latency networks. Performance optimization involves refining algorithms, minimizing processing times, and ensuring deterministic execution. Engineers employ efficient coding practices, parallel processing, and real-time monitoring tools to maintain peak performance. These efforts ensure systems can execute trades in microseconds, providing a competitive edge in fast-paced markets. Continuous optimization is essential to stay ahead in HFT’s demanding environment.

Regulatory Compliance and Risk Management

Regulatory compliance is a cornerstone of HFT, requiring adherence to frameworks like MiFID II and Dodd-Frank. Firms must implement robust risk management systems to monitor and mitigate potential market impacts. Tools like pre-trade and post-trade checks ensure compliance with trading rules. Managing operational risks, such as system failures, is critical to avoid financial losses. Balancing regulatory demands with high-performance trading remains a significant challenge in HFT development and execution.

Adaptation to Market Dynamics

HFT systems must rapidly adapt to changing market conditions to remain effective. This involves analyzing real-time data and adjusting strategies to capture emerging trends. Advanced algorithms incorporate machine learning to predict market movements and optimize trading decisions. Dynamic parameter adjustments enable systems to respond to volatility and shifting liquidity. Continuous monitoring and feedback loops ensure strategies evolve with market dynamics, maintaining competitive performance and minimizing risks in fast-paced environments.

Tools and Technologies for HFT Development

Key tools include programming languages like Python, C++, and Java, along with high-performance frameworks, APIs, and specialized hardware for accelerated trading and data processing.

Programming Languages (Python, C++, Java)

Python is favored for its simplicity and extensive libraries, enabling rapid strategy development and data analysis. C++ excels in high-performance applications due to its speed and low-latency capabilities. Java is valued for its platform independence and robust scalability, making it ideal for large-scale trading systems. These languages form the backbone of HFT, each contributing uniquely to strategy implementation, execution, and system integration.

High-Performance Computing Frameworks

High-performance computing frameworks are essential for optimizing HFT systems, enabling ultra-fast data processing and execution. Technologies like FPGAs and GPUs accelerate computations, while parallel processing frameworks ensure low-latency operations. These tools support the development of scalable, efficient trading systems, integrating seamlessly with programming languages to handle vast data volumes and complex algorithms, ensuring superior performance in competitive markets.

APIs and Trading Platforms

APIs and trading platforms serve as critical connectors between HFT systems and financial markets, enabling rapid order execution and data exchange. These tools provide access to exchanges, support real-time market data feeds, and facilitate seamless trade execution. Modern platforms offer scalability, reliability, and low-latency connectivity, while APIs like FIX and REST enable integration with various trading systems. They are indispensable for developers, ensuring efficient and secure interactions with global financial markets.

Post-Trade Analysis and Performance Metrics

Post-trade analysis evaluates HFT system performance, identifying inefficiencies and optimizing strategies. Key metrics include execution speed, profit-loss ratios, and trade accuracy, ensuring continuous system refinement and improvement.

Key Performance Indicators (KPIs) for HFT

In HFT, KPIs measure system efficiency, profitability, and risk. These include trade execution speed, order fill rates, profit-loss ratios, Sharpe Ratio, and Sharpe Ratio. Latency, throughput, and error rates are also critical metrics. Additionally, market impact and slippage are analyzed to assess trading strategy effectiveness. These indicators help refine algorithms, optimize performance, and ensure systems adapt to dynamic market conditions, maintaining competitiveness in high-speed trading environments.

Profit-Loss Analysis and Strategy Refinement

Profit-loss analysis is critical for evaluating HFT strategy effectiveness. By examining P&L statements, traders identify profitable patterns and areas for improvement. This process involves assessing trade execution quality, market impact, and risk-adjusted returns. Insights from P&L analysis guide strategy recalibration, enabling systems to adapt to evolving market conditions. Continuous refinement ensures sustained profitability and competitive advantage in high-speed trading environments, where precision and adaptability are paramount.

Future Trends in HFT

Emerging technologies like AI, machine learning, and quantum computing will shape HFT’s future, enabling faster decision-making and smarter strategies, while blockchain may enhance transparency and efficiency.

Role of AI and Machine Learning

AI and machine learning are revolutionizing HFT by enabling systems to analyze vast datasets, predict price movements, and optimize trading strategies in real-time. These technologies enhance pattern recognition, reduce latency, and improve decision-making accuracy. Advanced algorithms adapt to market dynamics, allowing for more robust and scalable HFT systems. AI-driven solutions also facilitate automated risk management and compliance monitoring, ensuring efficient and reliable trading operations in fast-paced financial markets;

Impact of Emerging Technologies (e.g., Blockchain)

Emerging technologies like blockchain are transforming HFT by enhancing transparency, security, and efficiency. Blockchain’s decentralized ledger ensures immutable transaction records, reducing fraud and operational risks. Smart contracts automate trading logic, enabling faster and cost-effective executions. Additionally, blockchain-based systems can streamline post-trade processes, such as settlement and reporting, while maintaining high throughput and low latency, making them complementary to HFT’s ultra-fast trading environments.

Evolution of Regulatory Frameworks

Regulatory frameworks for HFT have evolved to address market integrity and systemic risks. Initiatives like the SEC’s Market Information Data Analytics System (MIDAS) monitor high-speed trading activities. Authorities now mandate stricter reporting, order-to-trade ratios, and risk controls. These measures aim to prevent flash crashes and ensure fair market access. Regulators also focus on transparency, requiring firms to disclose HFT strategies and infrastructure. Such reforms balance innovation with oversight, fostering trust and stability in financial markets while adapting to technological advancements.

High-Frequency Trading (HFT) has revolutionized financial markets by leveraging advanced technologies and algorithms. Despite challenges like latency and regulatory compliance, HFT remains a critical component of modern trading. As markets evolve, the integration of AI, machine learning, and emerging technologies will shape the future of HFT. Continuous innovation and adaptation are essential for developers to stay competitive. HFT systems will continue to play a pivotal role in maintaining market efficiency and driving financial innovation globally.